Our passion is evident in the way we help each client.

AWS is a holistic financial services provider offering a culmination of three decades of combined industry experience to our client base in South Florida, across the US. We pride ourselves on a meticulous, yet comprehensive approach to addressing the financial goals and objectives of each client.

The AWS signature experience involves a tailor-made planning process that is completely client centric from getting to know our clients and understanding their needs to the execution and servicing of their individualized plan.

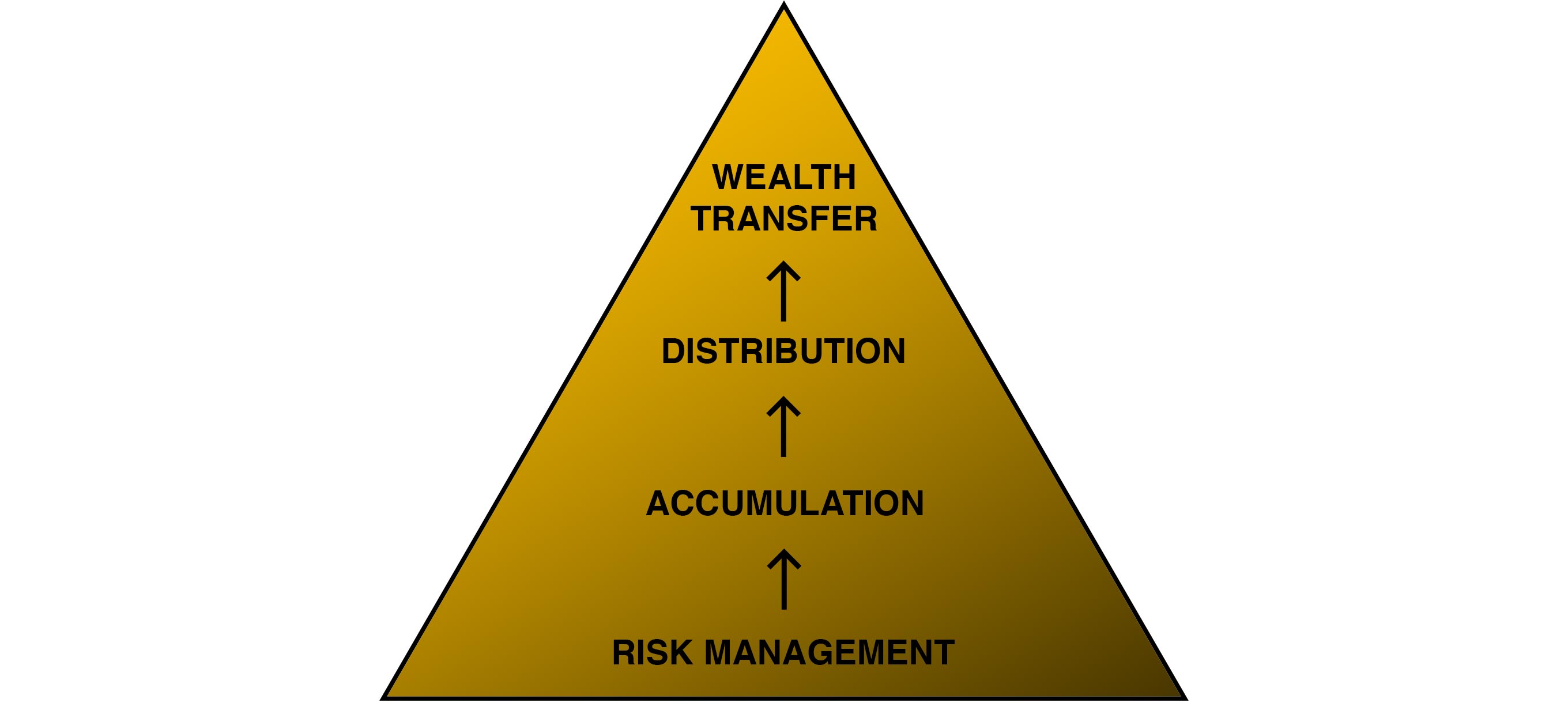

At AWS, it is of utmost importance for our clients to have a simplified understanding of each part of their financial roadmap without feeling overwhelmed. As such, we employ a 4 building block approach which is best analogized by ascending and descending a mountain. It starts at the drawing board by identifying potential risks and ways to manage the associated propensity of risk. Keep in mind, risk can never be eliminated. The next stage of planning focuses on accumulation and building wealth for our clients. This is achieved through in depth analysis with two concepts at the forefront, diversification and asset allocation. Thirdly, we focus our concentration on assembling effective distribution strategies of your assets. Picture having reached the top of the mountain, the time has come to safely get back down. The final stage of planning involves effective transfer of wealth and helping to ensure assets are transferred to the desired next of kin in the most tax efficient ways whilst simultaneously creating a legacy for future generations — a truly humbling yet gratifying journey for us, at Artisan Wealth Solutions.

The Artisan team is relentless in planning for our clients’ futures and we aim to leave no stone unturned during this process. Our mantra is to promote client confidentiality and the assurance that we are doing right by each individual who entrusts their planning to us. Many of our clients have existing relationships with other financial professionals; our goal is not to replace those relationships, but to complement them in any way possible to embrace a holistic overview.

Our specialized areas of focus include:

Insurance Planning and asset protection

While we cannot eliminate risk, we can surely help manage it to provide peace of mind and flexibility when it comes to planning for the ‘”what if” scenarios of our lives. Implementing defensive, wealth accumulation strategies in this area of planning is also common for the AWS team.

Wealth Management

We offer a systematic, tailored approach to investing utilizing both strategic and tactical wealth management platforms as well as access to renowned money managers.

Financial Planning

AWS is able to build a comprehensive statement of your long-term objectives for security and well-being and a detailed savings and investing strategy for achieving those objectives.

Business Succession Planning

We believe that the financial and personal investment you have in your business should be leveraged and protected to provide you with the legacy, confidence, and financial freedom you desire. Having the right options available is paramount.

Estate Planning

This is the most intricate layer of planning we assist with, collaborating with your legal and tax advisors. Estate planning can be a complex task however, a well-informed plan can make a big difference in what remains for your loved ones in the most efficient way.